Financing Options for Small Businesses to Acquire Rivetless Clinching Guns

Introduction

Rivetless clinching guns offer a cost-effective and efficient solution for fabricating sheet metal components. However, acquiring these specialized tools can be a significant financial investment for small businesses. To mitigate this challenge, various financing options are available to help entrepreneurs access the equipment they need.

Equipment Leasing

Leasing provides an alternative to purchasing rivetless clinching guns outright. With leasing, businesses make periodic payments to use the equipment for a specified period, typically ranging from two to five years. At the end of the lease term, the business can return the equipment, purchase it, or extend the lease.

Advantages:

– Conserves capital, freeing up funds for other business operations.

– Allows businesses to acquire the latest equipment without substantial upfront investment.

– Payments are tax-deductible as operating expenses.

Disadvantages:

– May involve higher interest rates than traditional loans.

– Limits ownership options at the end of the lease term.

Business Loans

Business loans are another common financing option for acquiring rivetless clinching guns. Businesses can borrow funds from banks, credit unions, or online lenders to purchase the equipment. The loan terms, including interest rates, repayment periods, and collateral requirements, vary depending on the lender and the borrower’s creditworthiness.

Advantages:

– Provides flexibility in equipment selection and financing terms.

– Can be used for other business expenses beyond equipment acquisition.

– Interest payments may be tax-deductible.

Disadvantages:

– Can involve higher interest rates for businesses with poor credit.

– Requires collateral to secure the loan, which can limit financing options for some businesses.

Equipment Financing

Equipment financing is a specialized type of loan designed specifically for acquiring capital equipment. Lenders typically offer low interest rates and flexible repayment terms to encourage businesses to invest in productivity-enhancing equipment.

Advantages:

– Interest rates are typically lower than business loans.

– Repayment schedules are tailored to match equipment depreciation.

– Equipment serves as collateral, reducing the risk for lenders.

Disadvantages:

– May require higher down payments.

– May have less flexibility in loan terms.

Vendor Financing

Some manufacturers and distributors of rivetless clinching guns offer in-house financing programs. These programs can provide competitive interest rates and flexible payment options to facilitate equipment acquisition.

Advantages:

– Can be convenient and tailored to the equipment being purchased.

– May offer lower interest rates for qualified buyers.

– May include additional perks, such as technical support or equipment warranties.

Disadvantages:

– May not be available for all businesses or equipment models.

– May involve higher financing fees than other options.

Conclusion

Financing options for small businesses to acquire rivetless clinching guns allow entrepreneurs to access the equipment necessary for efficient and cost-effective metal fabrication. By carefully considering the advantages and disadvantages of each option, businesses can secure the financing that meets their specific needs and budget.

- Company News

- Industry News

- Tag

- Tags

-

The Advantages of Questok Rivet Guns: Precision, Efficiency, and Durability

In industrial fastening applications, the choice of tools directly impacts productivity, safety, and long-term cost-effectiveness. Questok rivet guns have emerged as a standout solution for professionals across aerospace, automotive, and construction sectors. Combining advanced engineering with user-centric design, these tools deliver unmatched performance. Below are the key advantages that make Questok rivet guns a preferred choice:

-

Rivet Gun FAQ

Rivet Gun FAQ-SPR

-

Fast Assembly and Repair With Cordless Solid Rivet Gun

Questok cordless solid rivet gun stands out as a pivotal innovation, merging portability with power to facilitate efficient and effective fastening in a myriad of applications.

-

Redifine The Role of Self-piercing Riveting Gun Machine

Self-piercing riveting adopts high-speed mechanical fastening skill that joins thin sheet materials, typically steel and aluminum alloys.

-

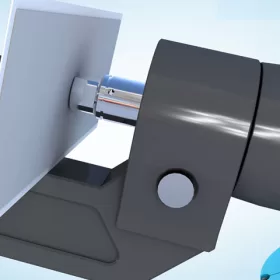

The Latest Innovations in Clinching Tool Design

Explore the latest innovations in clinching tool design, redefining precision, efficiency, and versatility in material joining.

-

The Application and Maintenance of Self-Piercing Rivet Guns

Delve into the applications of self-piercing rivet guns in the automotive and aerospace industries and reveal the essential maintenance practices that ensure their accuracy and efficiency.

-

Rivetless Riveting Gun for Ventilation Duct Projects

The ventilation duct rivetless gun is a tool for riveting ventilation ducts without rivets.

-

Guide to Using Self-Piercing SPR Riveting Gun

In the automotive industry, self-piercing SPR (Self-Piercing Rivet) riveting guns are commonly used for joining metal components in vehicle bodies, including BMW vehicles.

-

Rivet Gun FAQ

Rivet Gun FAQ-SPR

-

Versatile Fastening- Applications of the Handheld Rivet Gun Across Industries

In the realm of fastening, the handheld rivet gun stands as a testament to ingenuity and versatility. Its ability to effortlessly join materials with sheer strength and permanence has revolutionized manufacturing and construction processes, leaving an enduring mark on diverse industries. Aerospace: Where precision and reliability are paramount, the rivet gun shines. In aircraft assembly, […]

-

Time-Saving Tools- Speeding Up Projects with Electric Blind Rivet Guns

In the whirlwind of project deadlines, every minute counts. But what if there was a tool that could dramatically reduce assembly time, giving you an edge in the race against the clock? Enter the electric blind rivet gun: your secret weapon for lightning-fast and effortless riveting. Electric blind rivet guns are the ultimate time-savers for […]

-

Streamlining Fastening- How an Electric Blind Rivet Gun Enhances Efficiency

Introduction In the realm of manufacturing and assembly, fastening plays a crucial role in securing components and ensuring structural integrity. Traditional manual rivet guns, while reliable, are often time-consuming and labor-intensive. The advent of electric blind rivet guns has revolutionized the fastening process, significantly enhancing efficiency and productivity. This article delves into the benefits of […]

-

The Role of Automation in Electric Rivetless Clinching

Electric rivetless clinching (ERC) is a lightweight joining process that eliminates the need for rivets or other fasteners. This can lead to significant cost savings and increased production efficiency. Automation plays a critical role in ERC, enabling high-speed and high-volume production. Automated Feed Systems Automated feed systems are used to accurately position the two workpieces […]

-

Why Choose a Universal Self-Piercing Riveting Gun for Your Projects?

In the realm of construction and fabrication, riveting guns stand as indispensable tools for creating secure and robust connections. Among the various types available, universal self-piercing riveting (SPR) guns have emerged as a game-changer due to their versatility and efficiency. This article will delve into the compelling reasons why choosing a universal self-piercing riveting gun […]

-

Why Choose Stainless Steel Hollow Rivets for Your Projects?

In the world of industrial manufacturing, choosing the right fasteners for your projects is crucial for ensuring longevity and reliability. Among the many options available, stainless steel hollow rivets stand out as a superior choice for a wide range of applications. This article delves into the compelling reasons why stainless steel hollow rivets are the […]

-

Top Trends in Electric Rivetless Clinching Guns

In the realm of fastening technology, electric rivetless clinching guns have emerged as a revolutionary solution for a wide range of industrial applications. These advanced tools offer several преимущества and capabilities, revolutionizing the way businesses approach their fastening needs. Adoption of Brushless Motors Brushless motors have gained significant traction in electric rivetless clinching guns due […]