Financing Options for Investing in Portable Clinching Tools

Portable clinching tools have revolutionized the metalworking industry, providing manufacturers with a lightweight, versatile, and cost-effective alternative to traditional riveting and welding techniques. These tools offer numerous advantages, including improved joint strength, reduced downtime, and increased productivity. However, the initial investment in portable clinching tools can be substantial, making it crucial for businesses to explore various financing options to make this investment more manageable.

Types of Financing Options

Vendor Financing: Many portable clinching tool manufacturers offer financing programs to their customers. These programs typically involve a down payment, followed by regular monthly or quarterly payments over a specified period. Vendor financing often provides competitive interest rates and flexible repayment terms.

Equipment Leasing: Leasing is a common financing option for portable clinching tools. Businesses can lease the tools for a predetermined period, usually ranging from 12 to 60 months. At the end of the lease term, the lessee can choose to purchase the tools, return them, or renew the lease. Leasing offers tax advantages and allows businesses to conserve capital.

Bank Loans: Bank loans are a traditional financing option for businesses of all sizes. Banks typically offer loans with varying interest rates, terms, and collateral requirements. Bank loans may require a larger down payment and stricter credit requirements compared to vendor financing or equipment leasing.

Government Grants and Loans: In some cases, government agencies or economic development organizations may offer grants or loans to businesses that invest in new equipment, including portable clinching tools. These programs can provide access to low-interest or no-interest financing options, but they often have specific eligibility criteria and application requirements.

Factors to Consider When Choosing a Financing Option

Cost: The total cost of the financing, including interest payments, fees, and other charges, should be carefully evaluated. Businesses should compare different financing options and choose the one that minimizes the overall cost.

Flexibility: The flexibility of the financing option is important for businesses that may need to adjust their payment schedule in the future. Some financing options, such as equipment leasing, offer more flexibility in terms of payment timing and the ability to terminate the lease early.

Collateral: Some financing options, such as bank loans, may require collateral, which can be a risk for businesses that do not have sufficient assets. Businesses should consider the value of the collateral required and the potential impact if they default on the loan.

Tax Implications: The tax implications of the financing option should be considered. Leasing offers tax advantages, as lease payments are typically tax-deductible as operating expenses. Bank loans may provide more flexibility in terms of depreciation and interest deductions.

Conclusion

Investing in portable clinching tools can provide businesses with significant benefits in terms of increased efficiency, productivity, and profitability. Exploring various financing options can make this investment more manageable and allow businesses to acquire these tools without straining their financial resources. By carefully considering the factors discussed above, businesses can choose the financing option that best aligns with their financial goals and operational needs.

- Company News

- Industry News

- Tag

- Tags

-

The Advantages of Questok Rivet Guns: Precision, Efficiency, and Durability

In industrial fastening applications, the choice of tools directly impacts productivity, safety, and long-term cost-effectiveness. Questok rivet guns have emerged as a standout solution for professionals across aerospace, automotive, and construction sectors. Combining advanced engineering with user-centric design, these tools deliver unmatched performance. Below are the key advantages that make Questok rivet guns a preferred choice:

-

Rivet Gun FAQ

Rivet Gun FAQ-SPR

-

Fast Assembly and Repair With Cordless Solid Rivet Gun

Questok cordless solid rivet gun stands out as a pivotal innovation, merging portability with power to facilitate efficient and effective fastening in a myriad of applications.

-

Redifine The Role of Self-piercing Riveting Gun Machine

Self-piercing riveting adopts high-speed mechanical fastening skill that joins thin sheet materials, typically steel and aluminum alloys.

-

The Latest Innovations in Clinching Tool Design

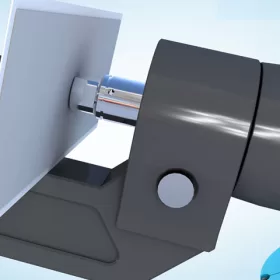

Explore the latest innovations in clinching tool design, redefining precision, efficiency, and versatility in material joining.

-

The Application and Maintenance of Self-Piercing Rivet Guns

Delve into the applications of self-piercing rivet guns in the automotive and aerospace industries and reveal the essential maintenance practices that ensure their accuracy and efficiency.

-

Rivetless Riveting Gun for Ventilation Duct Projects

The ventilation duct rivetless gun is a tool for riveting ventilation ducts without rivets.

-

Guide to Using Self-Piercing SPR Riveting Gun

In the automotive industry, self-piercing SPR (Self-Piercing Rivet) riveting guns are commonly used for joining metal components in vehicle bodies, including BMW vehicles.

-

Rivet Gun FAQ

Rivet Gun FAQ-SPR

-

Streamlining Fastening- How an Electric Blind Rivet Gun Enhances Efficiency

Introduction In the realm of manufacturing and assembly, fastening plays a crucial role in securing components and ensuring structural integrity. Traditional manual rivet guns, while reliable, are often time-consuming and labor-intensive. The advent of electric blind rivet guns has revolutionized the fastening process, significantly enhancing efficiency and productivity. This article delves into the benefits of […]

-

User-Friendly Features- Making Riveting Easy with Electric Blind Rivet Guns

Electric blind rivet guns are essential tools for industrial applications, providing a convenient and efficient way to fasten materials together. These tools have significantly advanced, incorporating user-friendly features that enhance their functionality and ease of operation. This article explores several key user-friendly features of electric blind rivet guns, highlighting how they simplify and streamline the […]

-

Unleashing Potential- Unlocking the Versatility of a Handheld Rivet Gun

In the realm of construction and fabrication, precision and efficiency reign supreme. Among the indispensable tools that empower craftsmen and DIY enthusiasts alike, the handheld rivet gun stands as a beacon of versatility and innovation. This unassuming device harbors a hidden potential that belies its compact form, offering a plethora of applications that unlock unbounded […]

-

The Role of Automation in Electric Rivetless Clinching

Electric rivetless clinching (ERC) is a lightweight joining process that eliminates the need for rivets or other fasteners. This can lead to significant cost savings and increased production efficiency. Automation plays a critical role in ERC, enabling high-speed and high-volume production. Automated Feed Systems Automated feed systems are used to accurately position the two workpieces […]

-

Why Choose a Universal Self-Piercing Riveting Gun for Your Projects?

In the realm of construction and fabrication, riveting guns stand as indispensable tools for creating secure and robust connections. Among the various types available, universal self-piercing riveting (SPR) guns have emerged as a game-changer due to their versatility and efficiency. This article will delve into the compelling reasons why choosing a universal self-piercing riveting gun […]

-

Why Choose Stainless Steel Hollow Rivets for Your Projects?

In the world of industrial manufacturing, choosing the right fasteners for your projects is crucial for ensuring longevity and reliability. Among the many options available, stainless steel hollow rivets stand out as a superior choice for a wide range of applications. This article delves into the compelling reasons why stainless steel hollow rivets are the […]

-

Top Trends in Electric Rivetless Clinching Guns

In the realm of fastening technology, electric rivetless clinching guns have emerged as a revolutionary solution for a wide range of industrial applications. These advanced tools offer several преимущества and capabilities, revolutionizing the way businesses approach their fastening needs. Adoption of Brushless Motors Brushless motors have gained significant traction in electric rivetless clinching guns due […]